Win Rate Calculator for Forex: Unlocking Your Trading Potential

Introduction

Forex trading can be a thrilling journey, filled with opportunities and challenges. One of the most critical factors that can make or break your success in this market is your win rate. A win rate calculator for Forex is an essential tool for traders looking to assess their performance and improve their strategies. In this article, we’ll delve into the significance of win rates, how to calculate them, and how a win rate calculator can enhance your trading game.

Understanding Win Rate in Forex

What is Win Rate?

Win rate is the percentage of trades that result in a profit. It is a vital metric that gives traders insight into their trading performance. For instance, if you execute 100 trades and 55 of them are profitable, your win rate is 55%. This figure can provide a snapshot of your trading effectiveness and help identify areas for improvement.

Why Win Rate Matters

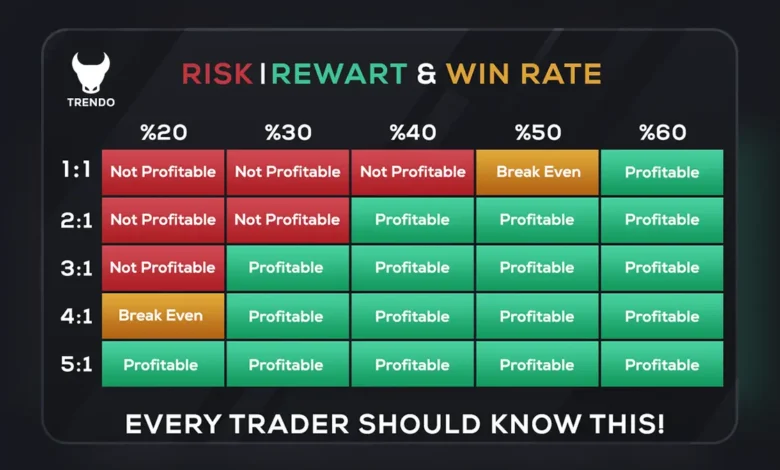

The importance of win rate in Forex trading cannot be overstated. A higher win rate generally indicates a more successful trading strategy. However, it’s crucial to understand that a high win rate doesn’t always equate to profitability. For example, if your winning trades are small compared to your losing trades, a high win rate might still result in an overall loss. Therefore, win rate should be analyzed alongside other metrics, such as risk-to-reward ratio.

How Win Rate Influences Trading Decisions

Traders often use win rate to gauge the effectiveness of their strategies. If a trader notices that their win rate is decreasing, it may signal the need to reevaluate their approach. Conversely, a high win rate can boost a trader’s confidence and encourage them to take calculated risks. By understanding how win rate impacts trading decisions, traders can refine their strategies to enhance overall performance.

The Mechanics of Calculating Win Rate

The Formula for Win Rate Calculation

Calculating win rate is straightforward. The formula is:

Win Rate=(Number of Winning TradesTotal Number of Trades)×100\text{Win Rate} = \left( \frac{\text{Number of Winning Trades}}{\text{Total Number of Trades}} \right) \times 100Win Rate=(Total Number of TradesNumber of Winning Trades)×100

To illustrate, let’s say you’ve made 50 trades, with 30 being profitable. Plugging these numbers into the formula gives you:

Win Rate=(3050)×100=60%\text{Win Rate} = \left( \frac{30}{50} \right) \times 100 = 60\%Win Rate=(5030)×100=60%

This means 60% of your trades were winners, providing a clear view of your trading performance.

Tracking Your Trades

To accurately calculate your win rate, meticulous record-keeping is essential. Traders should maintain a trading journal that documents every trade, including entry and exit points, reasons for taking the trade, and results. This data not only helps in calculating win rate but also provides insights for future trades. Over time, reviewing this journal can reveal patterns and trends, enabling you to adjust your strategies accordingly.

Challenges in Calculating Win Rate

While calculating win rate seems simple, several challenges can arise. For instance, some traders may include trades that should not count toward their win rate, such as those based on impulsive decisions or external advice. Moreover, the win rate can vary significantly depending on the trading strategy employed, time frame analyzed, and market conditions. Therefore, it’s crucial to define parameters clearly when assessing win rate.

Leveraging a Win Rate Calculator for Forex

What is a Win Rate Calculator?

A win rate calculator is a tool that simplifies the process of calculating your win rate. These calculators can be found online or integrated into trading platforms. By entering your trade data, such as the number of winning trades and total trades, you can quickly obtain your win rate without doing manual calculations.

Benefits of Using a Win Rate Calculator

Using a win rate calculator can save time and reduce errors in calculation. It allows traders to focus more on analyzing their performance rather than crunching numbers. Additionally, many calculators provide insights into other performance metrics, such as average trade duration and profit per trade, enabling a more comprehensive evaluation of trading performance.

Choosing the Right Calculator

When selecting a win rate calculator, consider factors such as user interface, additional features, and reliability. Some calculators offer customizable options that allow you to input specific criteria relevant to your trading style. It’s essential to choose one that suits your needs and enhances your trading analysis process.

Interpreting Your Win Rate: What It Means for Your Strategy

High Win Rate vs. Low Win Rate

Understanding the implications of high and low win rates is critical for any trader. A high win rate (70% or more) can indicate a robust trading strategy. However, it’s essential to assess the risk-to-reward ratio as well. If the average profit per winning trade is small compared to losses, you might still face losses overall.

Conversely, a low win rate (below 40%) might seem alarming, but it could be acceptable if the average win is significantly higher than the average loss. This approach is often seen in strategies that rely on fewer, high-conviction trades rather than frequent small wins.

Adjusting Your Strategy Based on Win Rate

Once you’ve calculated your win rate, it’s time to analyze its implications. If your win rate is lower than expected, consider reassessing your strategy. Are you following your trading plan? Are you trading in volatile market conditions? Adjusting your strategy to improve win rate may involve refining your entry and exit criteria, implementing better risk management practices, or even changing the currency pairs you trade.

The Role of Discipline and Consistency

Ultimately, discipline and consistency are key components that can influence your win rate. Sticking to your trading plan, regardless of market emotions, will help maintain a steady performance. A disciplined approach ensures that you make decisions based on data rather than impulses, which can lead to a more favorable win rate over time.

Advanced Metrics Related to Win Rate

Risk-to-Reward Ratio

Understanding the risk-to-reward ratio is critical when interpreting your win rate. This metric indicates how much you stand to gain compared to how much you risk on a trade. A favorable risk-to-reward ratio can allow you to have a lower win rate while still being profitable. For example, a 1:3 risk-to-reward ratio means that for every dollar you risk, you stand to make three. This can make a 40% win rate profitable if your winning trades yield significantly larger profits than your losses.

Expectancy: A Deeper Look

Expectancy takes into account both your win rate and your average win/loss ratio. The formula for expectancy is:

Expectancy=(Win Rate×Average Win)−(Loss Rate×Average Loss)\text{Expectancy} = (\text{Win Rate} \times \text{Average Win}) – (\text{Loss Rate} \times \text{Average Loss})Expectancy=(Win Rate×Average Win)−(Loss Rate×Average Loss)

A positive expectancy indicates a potentially profitable trading strategy, regardless of win rate. This metric can help traders evaluate whether their approach is sustainable in the long run.

Trade Frequency and Its Impact

The frequency of trades can also affect your win rate and overall profitability. High-frequency trading may yield a higher number of trades and potentially a higher win rate, but it may also involve increased transaction costs and emotional strain. Conversely, a lower trading frequency might allow for more strategic and thoughtful decisions, leading to better performance in terms of win rate and profitability.

Common Mistakes to Avoid with Win Rate Calculators

Ignoring Other Performance Metrics

One common mistake traders make is focusing solely on win rate while neglecting other critical metrics. A high win rate may look impressive, but it can be misleading if it comes with low average profits or high transaction costs. Always consider win rate in conjunction with other metrics to gain a complete picture of your trading performance.

Misinterpreting the Data

Another pitfall is misinterpreting the win rate data. Some traders may think that a high win rate guarantees profitability, leading them to take excessive risks. It’s essential to remember that win rate is just one piece of the puzzle. Ensure you’re considering all aspects of your trading strategy and performance.

Failing to Update Your Records

Lastly, neglecting to keep your trading records updated can lead to inaccurate win rate calculations. As your trading evolves, so should your records. Regularly update your trading journal and make sure the data you input into the win rate calculator is current and accurate.

Conclusion

A win rate calculator is an invaluable tool for any Forex trader looking to assess and improve their trading performance. By understanding how to calculate and interpret your win rate, you can make informed decisions that enhance your trading strategy. Remember that win rate is just one aspect of your overall trading performance. By considering additional metrics such as risk-to-reward ratio and expectancy, you can develop a more comprehensive understanding of your trading effectiveness.

As you continue your trading journey, embrace the lessons learned from your win rate and apply them to refine your strategies. With discipline, consistency, and the right tools at your disposal, you can unlock your trading potential and pave the way for long-term success in the Forex market.

you may also read

usainfotime.com